When it comes to insurance, whether it’s for your car, home, or health, premiums can often feel like a significant financial burden. However, the good news is that there are multiple ways to lower your insurance premiums without compromising on coverage. In this comprehensive guide, we’ll explore effective strategies and actionable tips that can help you reduce your insurance costs while maintaining the protection you need.

Understand Your Insurance Policy Thoroughly

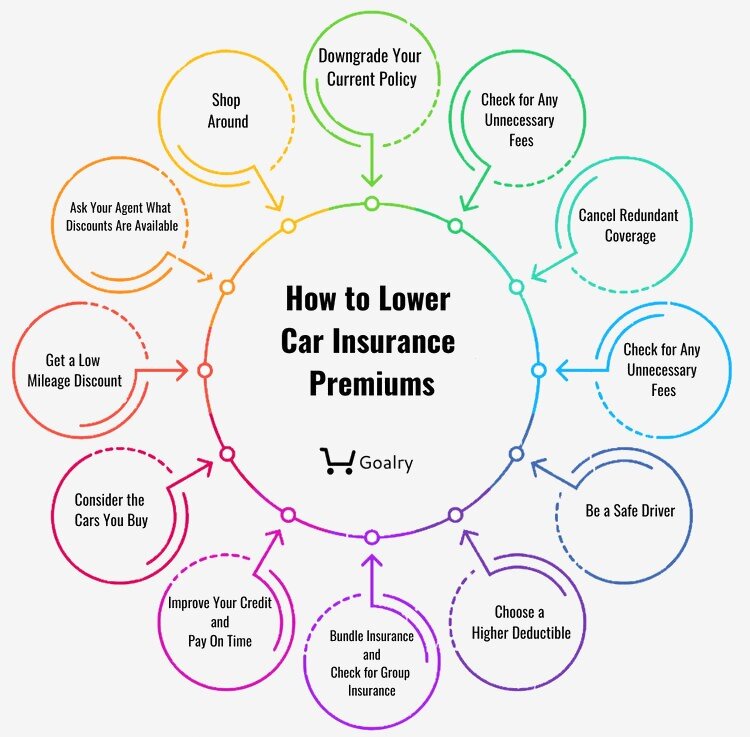

The first step in lowering your insurance premiums is to have a complete understanding of what your policy covers. Many people don’t realize that they may be paying for coverage they don’t need or are unaware of optional ways to adjust their policy for lower premiums.

Review Your Coverage Limits

One of the easiest ways to save money on your premiums is by reviewing the coverage limits in your policy. Often, people opt for the highest coverage without considering whether it’s truly necessary. For instance, in auto insurance, if you’re driving an older car, you may not need comprehensive coverage. Similarly, for homeowners, you might be able to adjust the policy limits for personal property or liability coverage based on the actual value of your possessions and needs.

Eliminate Redundant Coverage

Check whether you’re paying for coverage that overlaps with other policies. For example, if you already have an excellent health insurance plan, you may not need certain aspects of your life insurance or accidental coverage. By eliminating redundant coverage, you can significantly lower your premiums.

Shop Around and Compare Quotes

Just like with any major purchase, shopping around is crucial. Different insurance companies have varying rates for the same coverage, so it pays to compare quotes from multiple providers. Keep in mind that some companies offer discounts for bundling policies (e.g., combining car and home insurance), so take advantage of these opportunities.

Use an Insurance Broker

If you’re overwhelmed by the options or don’t have the time to compare policies, an insurance broker can help you find the best deals. Brokers have access to a wide range of insurance products and can recommend the best options based on your needs and budget.

Switch Providers Regularly

Insurance companies often provide discounts for new customers but offer less favorable terms upon renewal. To avoid paying higher premiums, it’s worth switching insurance providers every few years. While this might take a little effort, it can lead to substantial savings in the long run.

Increase Your Deductibles

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premiums. This is especially beneficial if you’re in a financial position where you can comfortably cover a higher deductible if needed. For example, in auto insurance, you might increase your deductible from $500 to $1,000, which could lower your premiums significantly.

Consider Your Risk Tolerance

Before raising your deductible, it’s important to assess your risk tolerance. If you have a history of frequent claims, increasing your deductible might not be ideal. On the other hand, if you’ve been claim-free for years and feel comfortable with higher out-of-pocket expenses, this strategy can be highly effective in reducing premiums.

Maintain a Good Credit Score

Insurance companies often use your credit score to determine your premium rates, particularly for auto and homeowners insurance. Studies have shown that individuals with higher credit scores typically pay less for insurance because they’re seen as less risky.

Ways to Improve Your Credit Score

Improving your credit score can take time, but it’s worth the effort. Here are a few steps you can take to boost your credit score:

- Pay your bills on time, every time.

- Reduce outstanding debts.

- Keep your credit card balances low.

- Avoid applying for too much credit at once.

By focusing on improving your credit score, you can potentially lower your insurance premiums in the future.

Take Advantage of Discounts

Most insurance companies offer a variety of discounts that you might be eligible for. These discounts can significantly reduce your premiums, so it’s important to inquire about them when you’re shopping for insurance or reviewing your policy.

Common Insurance Discounts to Look for

- Safe Driver Discount – If you’ve been accident-free for several years, you may qualify for a safe driver discount.

- Multi-Policy Discount – Bundling your car, home, and life insurance with the same provider can save you money.

- Anti-Theft Devices – Cars equipped with security systems or home security devices may qualify for discounts.

- Good Student Discount – Many auto insurers offer discounts to students who maintain a certain GPA.

- Paperless Billing Discount – Signing up for paperless billing can sometimes lead to small savings.

Don’t hesitate to ask your insurer about these discounts, as they can add up to significant savings over time.

Improve Your Home’s Safety Features

For homeowners, improving your property’s safety can result in lower premiums. Insurance companies often reward policyholders who take steps to reduce risk. Here are some actions you can take to improve your home’s safety and lower your premiums:

Install a Security System

A home equipped with a security system is less likely to be burglarized, reducing the insurer’s risk. Many companies offer discounts for homes with monitored alarm systems, deadbolt locks, or fire alarms.

Upgrade Your Roof

If your home’s roof is old or in disrepair, it may be a higher risk for damage during storms. By upgrading to a more durable, hurricane-resistant roof, you can potentially lower your homeowner’s insurance premiums.

Disaster-Proof Your Property

Insurance companies often provide discounts for homes located in areas with low risk of natural disasters. By disaster-proofing your home (e.g., adding storm shutters or reinforcing structures), you can minimize the risk of damage and reduce your insurance costs.

Drive a Safer, Less Expensive Car

If you’re looking to lower your auto insurance premiums, the type of car you drive plays a significant role. Insurance rates vary by vehicle model, and some cars are cheaper to insure than others.

Opt for a Car with Lower Insurance Rates

Cars that are expensive to repair or replace, or those that are prone to theft, often come with higher premiums. Consider driving a car that is known for being safer and cheaper to insure, such as sedans or minivans. Additionally, vehicles with modern safety features, such as anti-lock brakes, airbags, and backup cameras, may qualify for discounts.

Keep Your Driving Record Clean

Maintaining a clean driving record is one of the most effective ways to keep your premiums low. Avoid traffic violations, and be cautious on the road to minimize accidents. A clean driving record not only leads to lower premiums but also positions you for more substantial discounts over time.

Monitor Your Insurance Policy Regularly

Once you’ve lowered your premiums, don’t forget to regularly monitor your policy. Life changes, such as moving to a new location, purchasing a new car, or significant changes in your health, can all impact your premiums. By staying on top of your insurance policy and making adjustments as needed, you can ensure you continue to receive the best possible rates.

Conclusion

Reducing your insurance premiums doesn’t require drastic sacrifices. By carefully reviewing your policy, comparing quotes, increasing deductibles, taking advantage of discounts, and making smart lifestyle changes, you can significantly lower your insurance costs. Remember to review your coverage regularly and stay proactive in seeking out savings opportunities. With these strategies, you can enjoy the peace of mind that comes with affordable insurance.