When it comes to protecting yourself, your business, and your assets, liability insurance plays a crucial role. Whether you’re a homeowner, a business owner, or an individual who regularly interacts with others, liability insurance can help safeguard you from financial risks that arise when you’re held legally responsible for injuries or damages.

This article will explain what liability insurance is, how it works, and who should consider having it. By the end, you’ll understand why this type of insurance is essential for managing potential risks and avoiding costly legal troubles.

What Is Liability Insurance?

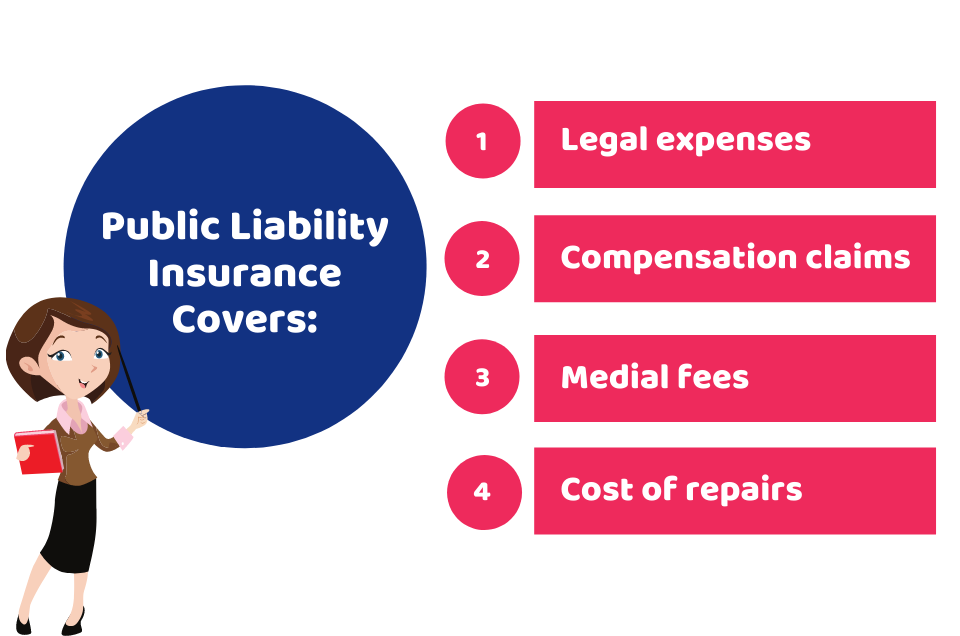

Liability insurance is a type of coverage that protects individuals and businesses from the financial consequences of being held legally responsible for harm or damage to others. It typically covers both the legal fees involved in defending a claim and any settlements or judgments awarded to the other party.

Liability insurance can be purchased as part of a broader policy, such as homeowners insurance, auto insurance, or business insurance, or as a standalone policy depending on your needs. The primary purpose is to help cover costs related to personal injuries or property damage that occur due to your actions or negligence.

Types of Liability Insurance:

- Personal Liability Insurance: This typically comes as part of homeowners or renters insurance policies. It covers injuries or property damage caused by the policyholder or their family members.

- General Liability Insurance: This is often purchased by businesses to cover accidents, injuries, or damage that occur as a result of business operations or interactions with customers.

- Professional Liability Insurance (Errors and Omissions Insurance): Professionals such as doctors, lawyers, and accountants purchase this insurance to protect themselves from lawsuits alleging negligence or subpar services.

- Product Liability Insurance: This type of insurance is for businesses that manufacture or sell products. It protects against claims related to injuries or damage caused by a defective product.

- Automobile Liability Insurance: This is required in most states for drivers. It covers bodily injury and property damage caused by a car accident, either to the other driver or their property.

Why Do You Need Liability Insurance?

Liability insurance is important because accidents happen, and when they do, you may be held financially responsible for the costs involved. Even the most careful individuals or businesses can face claims that result in expensive legal fees or settlements. Liability insurance offers peace of mind by covering these potential costs.

Benefits of Liability Insurance:

- Protection from Legal Fees: Legal defense can be expensive, and the costs associated with a lawsuit can quickly add up. Liability insurance can help cover attorney fees, court costs, and settlement amounts if you’re sued.

- Coverage for Injuries and Property Damage: If you or your business cause harm to others, liability insurance will cover the costs related to the injury or damage, including medical bills, repairs, and lost wages.

- Peace of Mind: Knowing you have insurance that can protect your financial interests allows you to take on risks more confidently, whether you’re running a business or simply enjoying your personal life.

- Protecting Your Assets: Without liability insurance, your personal or business assets, such as savings, property, and even future earnings, could be at risk in the event of a lawsuit.

Who Needs Liability Insurance?

Liability insurance is essential for a variety of individuals and organizations. Below are some examples of who should consider having liability coverage:

1. Homeowners and Renters

If you own a home or rent an apartment, personal liability insurance is crucial. It’s typically included in your homeowners or renters insurance policy. This type of insurance provides coverage if someone is injured while on your property or if you accidentally damage someone else’s property. For instance, if a guest slips and falls in your home and sues you for medical costs, your liability insurance can cover the expenses.

Do You Need It?

- If you own a home or rent, personal liability insurance should be a part of your policy. It can protect you against lawsuits resulting from accidents on your property.

- Even if you don’t own property, renters should also consider personal liability coverage since it can help cover damages that occur within the rented space.

2. Business Owners

If you own a business, having general liability insurance is crucial. It protects your business from financial losses caused by lawsuits related to bodily injury, property damage, or reputational harm. It also covers the costs of legal defense and settlements, which can be significant.

Types of Liability Coverage for Businesses:

- General Liability: Covers general risks like customer injuries on your business premises or property damage caused by your business operations.

- Professional Liability (Errors and Omissions): Protects professionals from claims of negligence or inadequate work.

- Product Liability: Covers claims that arise from the use of a product that causes injury or damage.

- Employer’s Liability: Covers claims from employees regarding workplace injuries or negligence.

Do You Need It?

- If your business involves interactions with clients, customers, or the public, liability insurance is a must.

- It’s also important for businesses with employees, as workers’ compensation might not cover all risks.

3. Drivers

Almost every state requires automobile liability insurance for drivers. This type of coverage helps pay for medical expenses, repairs, and damages if you’re involved in an accident and are at fault.

Do You Need It?

- If you own a car and drive it, you are legally required to have auto liability insurance in most states.

- If you have a car loan, your lender may also require you to carry this insurance.

4. Professionals

Professionals like doctors, lawyers, accountants, and consultants often carry professional liability insurance. This protects against claims of negligence, errors, or omissions in the services they provide.

Do You Need It?

- If you provide professional services or advice, professional liability insurance is highly recommended to protect yourself from legal claims due to mistakes or subpar work.

5. Landlords and Property Managers

If you rent out property, landlord liability insurance protects you from claims that arise due to tenant injuries or property damage. Additionally, property managers should also have liability insurance to protect against claims from tenants, contractors, or other third parties.

Do You Need It?

- If you own rental properties, landlord liability insurance is essential to protect your investment and cover risks that come with renting to tenants.

6. Anyone with Significant Assets

If you have significant assets—whether personal or business-related—you may want to purchase an umbrella liability policy. An umbrella policy provides additional coverage beyond your existing liability insurance, which can be especially valuable if you’re at risk of being sued for a large amount.

Do You Need It?

- If you have substantial personal or business assets, an umbrella policy is an extra layer of protection that can safeguard your wealth in case of a lawsuit.

How Much Liability Insurance Do You Need?

The amount of liability insurance you need depends on a variety of factors, including your assets, risk level, and the type of coverage you’re seeking. For individuals, personal liability coverage is typically between $100,000 and $500,000, but if you have significant assets, you may want to increase your coverage. Businesses should evaluate their risks and purchase enough coverage to protect against potential lawsuits, often ranging from $1 million to $5 million, depending on the size and nature of the business.

Conclusion: Liability Insurance is Essential

Liability insurance is a crucial protection that everyone should consider, whether you’re a homeowner, a business owner, a driver, or a professional. It helps shield you from potentially devastating financial losses in the event of an accident, injury, or lawsuit. By understanding the types of liability insurance available and who needs it, you can make informed decisions to safeguard your financial future.